10 reasons why high interest rates blow up the world

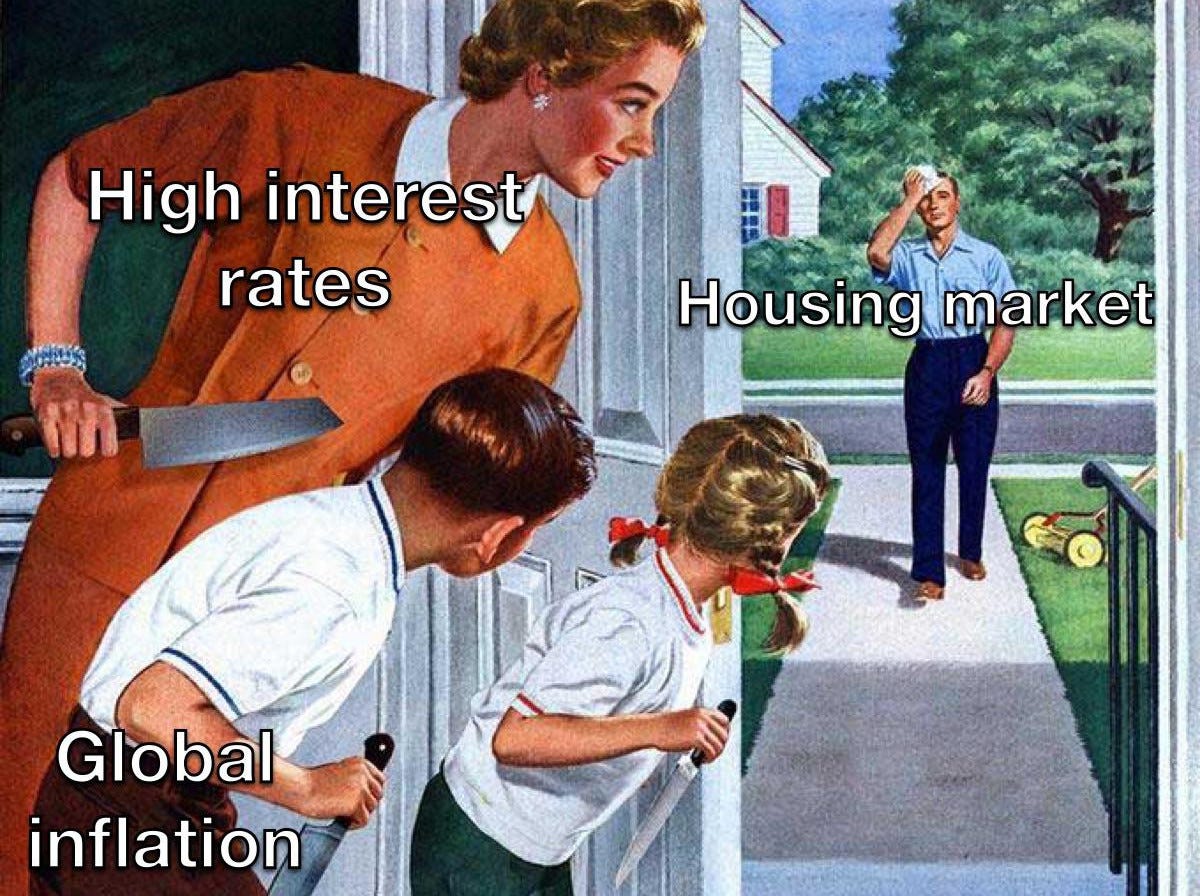

Browsing the comments section on Twitter I’ve noticed that a bunch of people don’t understand why higher interest rates and a crashing bond market are bad. In this post I’ll explain how higher rates are putting a dagger in the economy’s femoral artery, and why the talking heads are increasingly losing their shit over the state of the bond market.

1 – Mortgages are more expensive

Interest rates up = mortgage rates up. That means homeowners pay more for their mortgage which has all sorts of bearish implications for the economy. Plus, it obviously sucks for anyone who wants to buy a house.

2 – House prices go down

As mortgages get more expensive, consumers are forced to buy cheaper homes. Pay the same, get a crummier house! Or just don’t move. Reduced demand means that house prices go down.

You can make a very good case that house prices should go down, I get that. But still, prices going down is not a fun experience for anyone who owns a home, especially anyone who bought their home in the last few years.

3 – Borrowing is more expensive for consumers

Besides mortgages, all sorts of other borrowing becomes more expensive for the average Joe and Jane. Auto loans and credit card rates, just to name a few. All roads lead to economic contraction.

4 – Borrowing is more expensive for financial institutions

Financial institutions must also pay more to borrow. That can break the back of private equity and dry up VC funding. Also, higher rates = increased cost of leverage = institutions must reduce their leveraged positions = forced selling in the markets. This can put downward pressure on asset prices.

5 – Stocks must reprice lower

As I mentioned in a recent post, my primary focus for this month is learning how to value a company. While I haven’t figured out much yet, I do know enough to understand that a company’s valuation depends on the discount rate (risk free interest rate, I.e. treasuries). When interest rates are zero, the models can justify an investor paying a lot of money for a stock. I’ve even heard people muse that at 0% interest rates, some stocks could theoretically be worth infinity.

As interest rates rise, the discount rate goes up and a company’s valuation goes down. That means that stocks should be priced lower. Under the 0% interest rate regime tech stocks were some of the most richly valued, which explains why they’ve come down so much.

6 – Other countries have to raise rates

When the United States raises rates it forces other countries to hike their own interest rates, even if it hurts their economy. For example, Europe is (already in) heading into a recession but the ECB is still talking about rate hikes. The only reason they’re even saying the word “hike” is because the Fed is jacking up rates. Here’s why Europe must follow the Fed.

The Fed raises the FFR (Federal Funds Rate) to 4%. What happens if the ECB (or any other central bank) keeps rates at 0%? Great gobs of money will flow out of Europe and go into the United States to take advantage of that arbitrage. The carry trade in action.

If you want to see what happens when a country doesn’t raise rates to match the Yanks, look no farther than Japan. In the last six months the Japanese Yen’s non-viable viscera and pulpified organs have been plastered all the fuck over America’s high-rates windshield. The 10 year bond in Japan yields 0.25% and the American equivalent yields 4% as of Friday’s close. Which one would you rather hold?

Sane people prefer Hamburger over Sushi, so anyone with their head screwed on straight sells Yen and buys dollars (and dollar denominated assets). Rest in pickles (as my ex-girlfriend loved to say) to all the currencies that don’t match the Fed’s rate hikes.

7 – Zombie companies get headshot

Danielle DiMartino Booth is one of my favorite FinTwit personalities and she talks about zombie companies more than anyone else. A zombie company is any firm that has to continually borrow money just to stay alive. It doesn’t have enough cash flows to match its expenses.

Don’t quote me on this please, but something like 20% of all large American companies are the walking dead. Being a Zombie LLC is viable at 0% interest rates, but near impossible when rates rise.

Going from 3% to 10% debt servicing cost means that the zombies are head shotted towards bankruptcy. To be fair, this probably had to happen at some point. It’s not good for the world to keep the undead in a coma with monetary support tubes jammed down their squishy throats. Be that as it may, these firms going out of business means layoffs and economic contraction.

Reporting for work at a zombie company

8 – The government’s interest costs rise

Again, I don’t have the exact figures but I do have a good idea of the general theme (if you want the exact figures check out Luke Gromen, especially his latest podcast with Grant Williams).

If interest rates stay at 4 or 5%, the United States cannot afford to pay off its absurd debt load. The interest payments on the debt at 5% would add so much to the budget that the government wouldn’t have enough money from tax receipts to pay the tab. We would end up borrowing money to pay the interest owed on existing debt, like using a credit card to pay the interest charge on another credit card. That’s some real banana republic shit right there. Oooof.

Even if we don’t go full banana republic, every bip higher on interest rates means more money the USG has to pay to finance itself. That means less $$$ to spend on other things.

9 – Bond holders get taken out behind the woodshed

The problem with interest rates going up is that everyone who owns bonds get screwed. Bonds are down more than the S&P 500 this year. That, as FinTwit will remind you of 26 times a day, is exceedingly unusual. In the last 40 years bond prices have almost always gone up as stocks go down. Entire portfolios have been built around this phenomenon. Now that this strategy has stopped working there are millions of people hurting.

An average retiree, or pensioner if you’re from the tea-sipping country that couldn’t hold onto its colonies, might have seen the value of their portfolio go down 20, 30, 40% this year. I once watched my portfolio go down 85% in six months, but I’m young and have a secret talent for dealing with volatility (Stolichnaya). If you’re older and don’t like volatility, this is bad!

10 – Liquidity goes down as the value of the collateral drops

In a previous piece I wrote that our exalted central bank is not really central to the financial system. It’s a bit player that uses expectation policy to try and manipulate the markets. Who is central to our financial system? the Eurodollar network. What’s the currency of the realm for Eurodollar dealers? US treasuries.

The Eurodollar system uses treasuries as collateral and the value of said collateral is collapsing. Trillions of dollars of value has been wiped out of the bond market. A reduction in the value of the collateral means fewer loans, less lending into the real economy and forced deleveraging all around.

The end of ends

You could argue that all of this has to happen, that having zero percent interest rates for years was a massive fuckup and it’s high time we get back to “normal.” Fair enough, but with the amount of debt we have (public and private), getting back to normal would mean blowing up the financial system.

It’s like taking the smack away from a junkie. They’ve grown so accustomed to that sweet sultry skag that once it’s gone they freak out. Our economy’s gear is low interest rates, take that away and everything goes to hell. That’s the unfortunate truth of the situation that we now find ourselves in.