Guess what? The Fed is broke

If you look at the Fed, if it were a private entity it would be insolvent in a few weeks.

-Lyn Alden

Perhaps you’ve heard of the Federal Reserve? It’s a well-known quasi-government institution tasked with the dual mandate of manufacturing laughably inaccurate economic forecasts and protecting asset holders from losing too much money.

The Fed has done a good job with its mandates in the last decade so you might be surprised to learn that such a competent institution is on the brink of insolvency. Unfortunately that’s the situation that’s now confronting us. The Fed is broke and in this article we’re going to see how it happened, and why a new round of QE is imminent. Shall we begin?

Who banks the bankers?

The Federal Reserve has offices across the country, including large offices in expensive cities like Washington, New York and San Francisco. Furthermore, as of 2019 the Fed employs just under 23,000 people, many of whom have PhDs and thus require elevated salaries and latte bars. So who pays for all that designer coffee?

No seriously, take a second to think about it. I’ll wait.

The answer is interesting. The Fed funds itself via the returns it generates from its asset purchases. For example, the Fed currently has just over $8 trillion worth of assets on its balance sheet, primarily MBS (Mortgage Backed Securities) and Treasuries. These assets pay interest which the Fed collects and uses to pay for its own operations.

In fact, given the size of its balance sheet the Fed actually earns far in excess of what it needs to maintain operations. What does it do with the surplus? That’s easy, it sends it back to the government! Every year the Fed remits about $100 billion to the Treasury in what amounts to the world’s biggest tax return.

So the Fed funds itself by collecting interest payments on its vast portfolio of assets. How is it in trouble if it’s still holding trillions in yield generating securities?

IOER has the last laugh

There is another expense that I didn’t mention in the previous section: IOER or Interest on Excess Reserves.* Here’s how it works.

*For no good reason they’ve changed the nomenclature to IORB but I’m too cantankerous to change my ways.

- Large banks like JPMorgan and Goldman Sachs have accounts at the Federal Reserve. The same way that you or I keep our savings in a bank, these giant banks keep their “savings” (customer deposits) at the Fed.

- The Fed pays interest on these deposits and this is referred to as IOER.

- The Fed uses IOER to adjust interest rates. For example, when the Fed raises rates by 50 basis points they adjust IOER 0.5% higher (it’s currently set at 4.65%). The commercial banks raise their own lending rates accordingly and thus higher rates propagate throughout the economy.

Note — The reverse repo rate is also used to control interest rates in the economy.

The Fed has to pay IOER out of its budget. Historically this has not been a problem because the Fed was earning more from its assets than it had to pay out in interest expenses. For example, for much of the last decade the interest rate set by the Federal Reserve was at or near to 0%. That means the Fed had to pay essentially nothing on IOER. Here’s a simplified example with made up numbers.

- The Fed has $1 trillion in assets (MBS and government bonds) that yield 2%

- The Fed also has $1 trillion in bank deposits that it only has to pay 0.5% interest on (IOER)

Every year the Fed earns $20 billion from its assets while only paying out $5 billion. Everything is Gucci, until it isn’t…

Why the Fed is broke

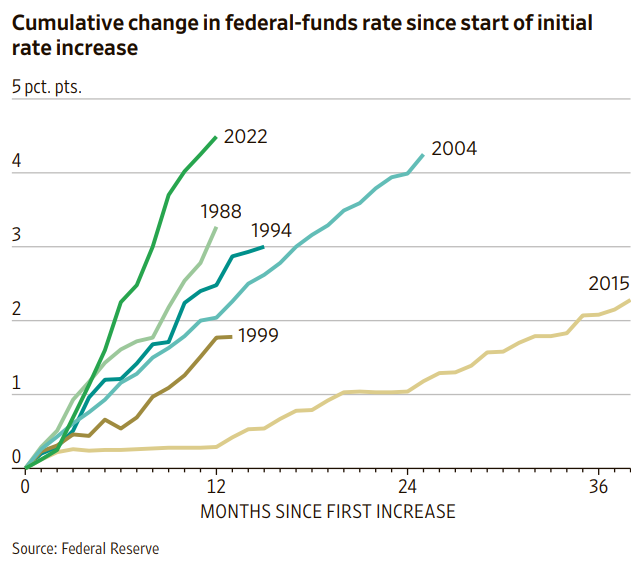

This has been the fastest rate hiking cycle since the invention of reality TV. As such the Fed’s liabilities (IOER payments) have been rapidly appreciating while its income has not increased enough to keep pace.

The Fed is still holding trillions of dollars of low-yielding debt that it purchased during the years of zero interest rates. The result is that in September of 2022 the Fed started paying out more in interest than it was earning from its assets. Here’s Lyn Alden from the 12:45 mark in this video.

Starting in September of last year, they [The Federal Reserve] raised their interest rates so quickly that for the first time in modern history the interest rate on their liabilities exceeds the interest rate on their assets and so the Federal Reserve is operating at a loss.

This imbalance can be sustained for a while because the Fed has a savings cushion, a roughly ~$40 billion buffer to draw on. However, that buffer is rapidly running out. Once it’s depleted, which could happen within the next month, the Fed will be cash flow negative. Here’s Jason Burack describing the situation.

You brought up the Fed and these interest payments, if the Fed was a publicly traded company and you could look at their financials and they were audited, you would say that their business is deeply cash flow negative right now. That’s due to those interest rate increases and the interest that they’re paying out to the banks now on interest on excess reserves (IOER)

So basically the world’s most powerful central bank is a meme stock that can only stay in business by borrowing. Or in the Fed’s case, by creating deferred assets. Here’s Lyn again.

Because of accounting gimmicks that they can do, those losses don’t get marked to market. They just get stored up as deferred assets. The way that works is that if the Fed ever becomes profitable again, rather than resuming their remittances to the Treasury right away, they need to pay back the hole that they dug themselves in first.

So basically they get to list that [insolvency] as not a big deal. Unlike a normal bank, they don’t go bankrupt the second that they have negative tangible equity.

That’s a fancy way of saying that instead of going bankrupt the Fed is going to bail itself out using the well-worn printing press. Crazy huh, that this is what’s going to start happening soon…

- The Fed will be engaged in (or pretending to engage in) quantitative tightening to reduce its balance sheet.

- The Fed will be raising interest rates in a heroic effort to defeat inflation by making everyone poorer.

- And at the same time… The Fed will be doing stealth QE whereby it’s creating reserves (deferred assets) to make interest payments on IOER. The Fed estimates that it will book $60 billion in deferred assets, although others have put the number much higher.

Pretty wild right? At the same time that the Fed is sending the economy into a recession with higher rates, they’re also going to be doing stealth QE and giving the money to JP Morgan and Goldman Sachs. Imagine how well that would all go over with the American populace if they knew about it?

Conclusions?

I personally don’t believe the Fed is going to be able to keep rates higher for years to come. However, maybe I’m wrong. Let’s just take the Fed at their word and assume that they’re going to do exactly that. But how?

Our financial system is set up in such a manner that the only way for the Fed to keep rates this high is to do stealth QE to ward off insolvency, or go hat in hand to Congress to get funding. Neither scenario plays out well in the headlines.

Remember, if the Fed goes to Congress to get funding it will be so that they can take that money and give it to JPM and Goldman. Political nightmare, thine name is that PR disaster. And one more thing, isn’t it just tragically funny that the Fed is asking every American business and citizen to contend with higher interest rates, yet the Fed itself is insolvent and only alive because it has a printing press? Not exactly leading by example…

I don’t know how any of this plays out but my guess is that we’ll be hearing more about the Fed’s insolvency soon. The Federal Reserve is broke, did you have that on your 2023 bingo card?